Helping your best customers grow their savings

Savings Growth = Deposit Growth

SoloStream helps you serve your small business self-employed customers that need tax savings management and your retail customers who save for all kinds of things.

Snap on, Plug in … Quick Connect

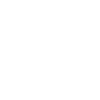

SoloStream’s new Fiserv Quick Connect application empowers banks and credit unions to better serve their self-employed customers—a highly profitable small business segment—with tools specifically designed to manage irregular income streams and automate tax savings.

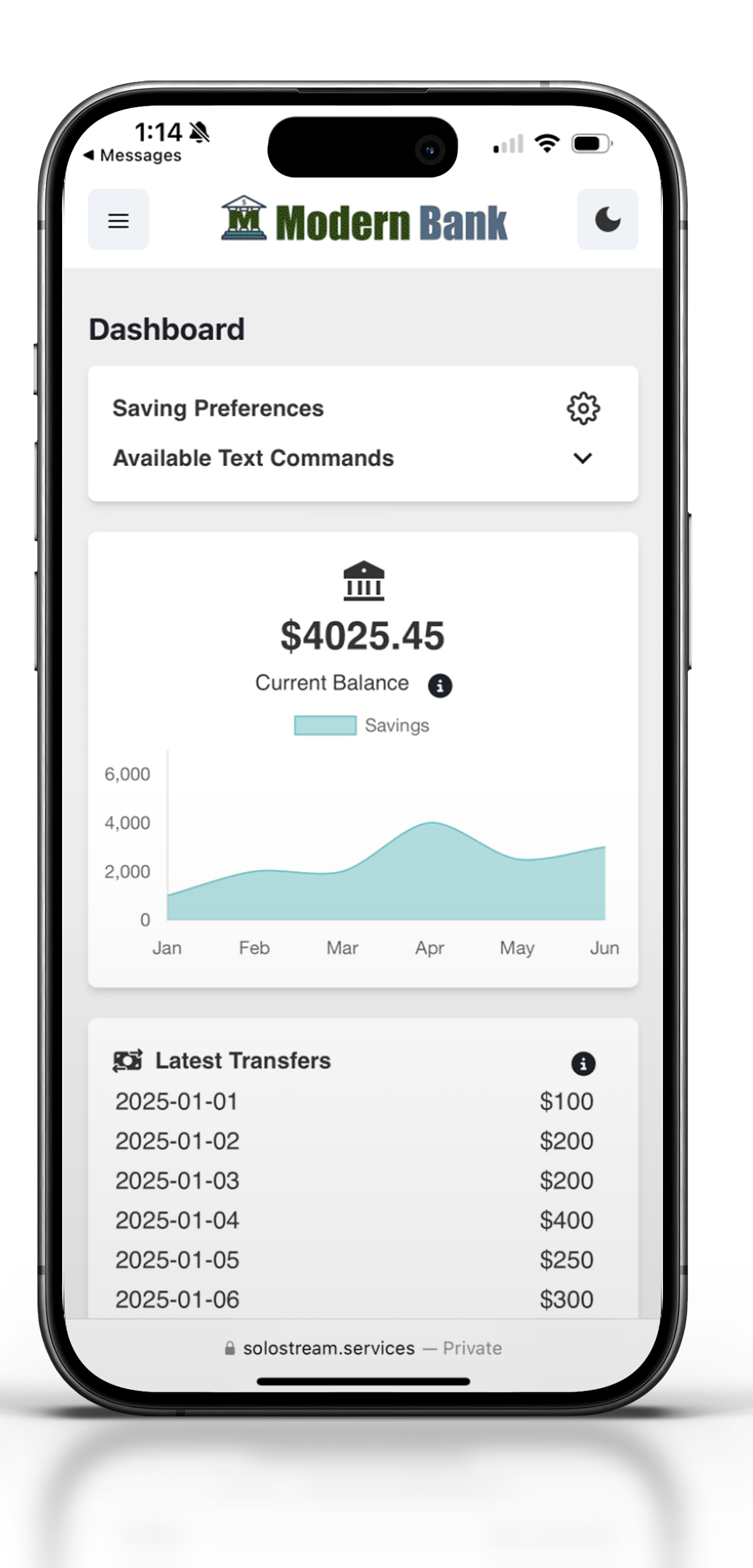

This deposit growth solution provides self-employed customers with enhanced visibility and control through timely notifications that encourage savings at the moment of income deposit and simple text commands for quick fund transfers.

The platform features an intuitive inline calculator with instant access to current US tax tables, showing self-employed workers their exact withholding requirements based on filing status and projected income. All functionality integrates seamlessly with existing accounts at the customer’s partnering financial institution.

Key Benefits for Financial Institutions

Easy to Implement Branded Mobile Features

Low-friction implementation works alongside established digital channels without requiring coding or complex integration

Competitive differentiation through specialized branded services for an underserved, high-value market segment

Deposit growth opportunity by attracting new self-employed customers and deepening relationships with existing ones

Enhanced customer loyalty through tools that address the unique financial challenges of self-employment

Transform Your Account Services with SoloStream Tax Saver for solo practicioners

Tailored Tax Savings Solutions

Solostream offers a unique, customized approach to tax savings accounts designed specifically for self-employed individuals. Our platform understands the complexities of self-employment income, providing personalized solutions that maximize tax benefits and simplify financial management.

Seamless Integration

Solostream products connect via pre-configured API integrations with your core. A fully branded experience takes no coding on your existing digital assets as we supplement those channels by matching UI and leveraging sms alerts and mobile web.

Attract New Customers

With Solostream, your bank can attract a growing and underserved market of self-employed professionals. Our innovative tax savings accounts provide a compelling reason for this segment to choose your institution, driving new customer acquisition and retention.

Enhance Customer Loyalty

By offering specialized tax savings accounts, your bank demonstrates a commitment to meeting the unique needs of self-employed customers. This dedication fosters trust and loyalty, ensuring long-term relationships and increased customer satisfaction.

Boost Revenue Streams

Solostream not only helps attract new customers but also opens up new revenue opportunities. With our tailored tax savings accounts, your bank can offer value-added services, such as small business services and investment advice, further enhancing your profitability.

Compliance and Security

Solostream ensures all accounts comply with the latest banking regulations and digital financial standards. Our robust security measures protect sensitive customer information, providing peace of mind for both your FI and your clients. By connecting directly to your core, we leave the important information where it’s supposed to be.

Join the SoloStream Revolution

Unlock the potential of your financial institution with Solostream and become a leader in serving the self-employed workforce. Partner with us today to offer innovative tax savings accounts that cater to the unique needs of this vital segment.